Wizz Air reported full-year revenue of €5.07bn, slightly below the estimated €5.13bn. Net income for the year was €376.6m, surpassing the estimated €342.9m. The airline projects its 2025 net income to range between €500m and €600m, with an estimate of €515m.

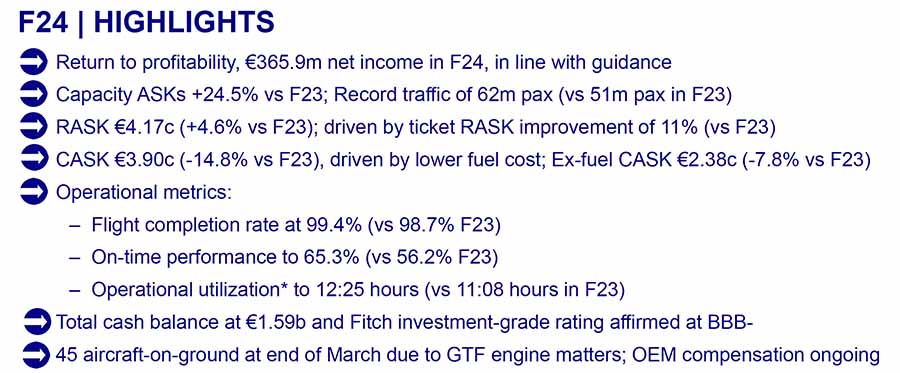

The company achieved a net profit of €365.9m for the year, compared to a net loss of €535m the previous year, ending a streak of three consecutive years of losses.

Low cost base continues to mark Wizz apart from its competitors (other than Ryanair), ex fuel CASK fell 7pc to €2.38 and an overall cost of €44.83 per passenger. This is down from €48.60 in 2023 and compares with €33.70 for Ryanair and €79.70 for Easyjet. Fleet is 209, 29 more than previous year. Wizz serves 193 destinations in 53 countries.

They carried 62m passengers in the year to March 2024 up 21pc on 2023, making them the seventh largest airline in Europe behind Ryanair, Lufthansa group, IAG, Air France/KLM, Turkish and Easyjet.

József Váradi CEO of Wizz Air said “Sustained healthy demand for air travel across our markets was a defining feature of F24, signalling that the surge witnessed post pandemic has evolved into a longer-term trend in consumer behaviour. Wizz Air has been strongly positioned for this trend as reflected in our performance for the year. We placed a sharp focus on increasing utilisation, improving load factors and lowering unit costs (fuel and ex-fuel), and continued to invest in our operations. Our efforts saw us carry a record number of passengers during the year, return to profitability and reduce financial leverage while maintaining our total cash position. We responded rapidly to challenges during the year by flexing resources and commercial arrangements, and quickly redeploying capacity where needed, as renewed geopolitical instability emerged. We also faced unprecedented supply chain disruption due to mandatory engine material inspections affecting our neo aircraft fleet. While some of the external challenges we experienced throughout F24, including groundings due to GTF engine inspections and geopolitical instability, are expected to persist in the coming year, we have proven that our model is agile, highly resilient and well positioned to mitigate the impact of these ongoing issues. This includes the current scale and diversity of our network, which means we are incredibly well placed to react quickly to issues as they arise.”