Boeing, a major U.S. exporter and aerospace giant, has experienced a second day of 10p cdecline in its stock value following the imposition of Trump’s tariffs, driven by fears that tariffs on key materials like aluminum and steel, as well as components from countries such as Canada, Mexico, and China, would increase production costs.

The travel sector, including airlines and cruise companies, has also felt the ripple effects of Trump’s tariffs, exacerbating economic uncertainty and dampening demand. Shares of major U.S. airlines like Delta and United have fallen approximately 20pc year-to-date as of late March 2025, while the S&P 500 passenger airlines index dropped about 15pc, underperforming the broader market. Low-cost carriers like Frontier saw smaller declines (around 2pc), but the overall trend reflects a sector under pressure. The price of Ryanair shares dropped marginally by 0.5pc.

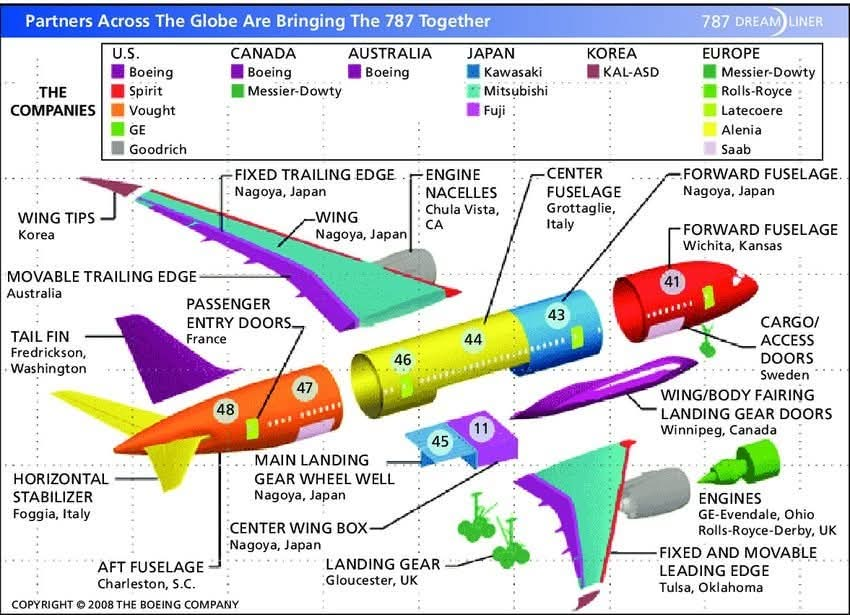

These tariffs, including a 25pc levy on imports from Canada and Mexico and a 10pc tariff on goods from China, threaten Boeing’s highly globalized supply chain, which relies on thousands of parts sourced worldwide. For instance, a Boeing 737 comprises about 2m parts from roughly 700 suppliers, many located in tariff-affected regions.

Analysts estimate that these duties could raise the cost of producing an aircraft by single-digit percentages, with some projections suggesting a worst-case scenario where a Boeing 787’s price could increase by up to $40m. This cost escalation poses a challenge for Boeing, already grappling with post-pandemic recovery, quality issues, and a recent strike that disrupted production in 2024. The company’s stock took a further hit as markets reacted to a broader sell-off, with shares tumbling 9.6pc on April 4, 2025, according to posts on X, reflecting investor unease about the tariffs’ impact on an industry still stabilizing after years of setbacks.

Moreover, the tariffs risk eroding Boeing’s competitive edge against Airbus, its European rival. Airbus, with manufacturing facilities in the U.S. (e.g., Mobile, Alabama), may be partially shielded from some tariff effects, potentially allowing it to capture more market share, particularly in China, where Boeing could lose ground if retaliatory measures favor Airbus or domestic manufacturer COMAC. This competitive pressure, combined with supply chain disruptions, has fueled a bearish outlook for Boeing’s stock in the short term.

The tariffs contribute to this downturn in several ways. First, higher aircraft production costs could translate into increased ticket prices as airlines pass on expenses to consumers, potentially reducing demand for discretionary travel.

Second, retaliatory tariffs from Canada, Mexico, and China—key markets for U.S. tourism—have raised concerns about reduced inbound travel. For example, Canadian travelers, impacted by their own economic adjustments to U.S. tariffs, are reportedly redirecting spending away from U.S. flights.

Third, broader economic fears, including the risk of a global recession spurred by a $5 trillion wipeout on Wall Street in early April 2025, have led tourists and businesses to cut back on travel spending, forcing carriers to lower profit forecasts for the first quarter.

Cruise companies have been hit even harder, with shares declining by as much as 13pc in early April 2025. This steeper drop likely stems from their reliance on international supply chains for shipbuilding and operations, as well as their sensitivity to consumer confidence, which has wavered amid trade war fears. The combination of higher operational costs and faltering demand has created a challenging environment for the travel industry.

The fallout in Boeing and travel shares is part of a larger market reaction to Trump’s tariff policies. These measures, aimed at addressing trade imbalances, have instead triggered a global trade war, with countries like China retaliating with tariffs on U.S. goods and Canada targeting aerospace materials like aluminum.

The resulting uncertainty has driven a broad market sell-off, with the S&P 500 poised to open significantly lower on April 3, 2025, and aerospace and travel stocks bearing a disproportionate burden due to their international exposure.

While some analysts suggest Boeing’s large order backlog and U.S.-centric defense contracts (e.g., the $20 billion F-47 fighter jet deal announced in March 2025) might mitigate long-term damage, the immediate impact has been a sharp decline in share prices and heightened volatility. For travel companies, the lack of a similar buffer leaves them more vulnerable to sustained weakness unless trade tensions ease or consumer confidence rebounds.

In summary, Trump’s tariffs have precipitated a significant fallout in Boeing and travel shares as of April 5, 2025, driven by rising costs, competitive pressures, and weakened travel demand, with the full scope of the damage still unfolding as markets and industries adjust to this new trade landscape.