The debate surrounding Ireland’s tourism figures, as reported by the Central Statistics Office (CSO), continues to spark contention among industry stakeholders, policymakers, and analysts as the nation grapples with understanding the true state of its vital tourism sector.

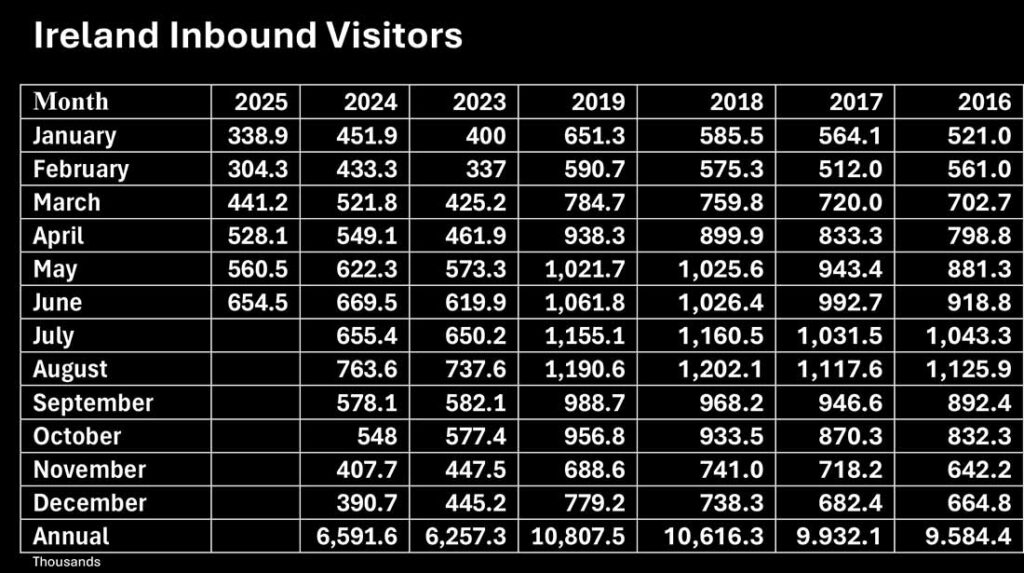

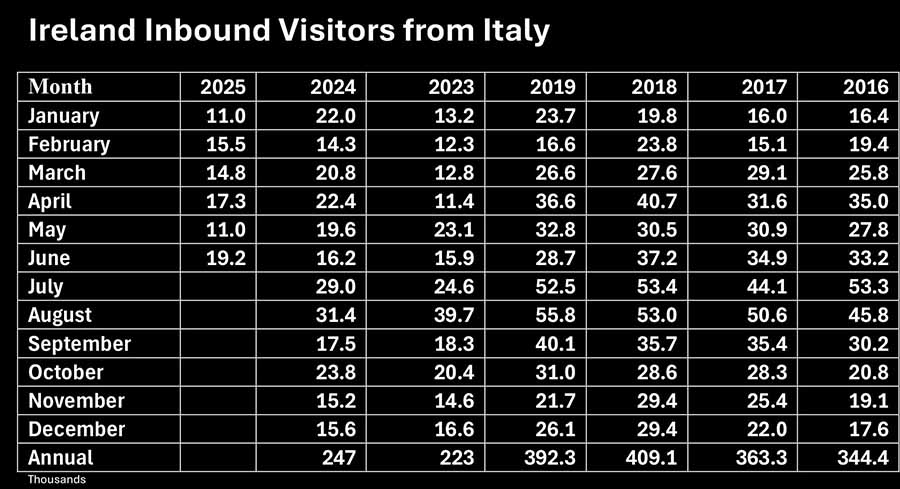

Recent CSO data has painted a troubling picture, indicating significant declines in foreign visitor numbers for the early months of 2025, with a reported 25pc drop in January and a 30pc decrease in February compared to the previous year. These figures, drawn from the CSO’s Inbound Tourism series, have raised alarm bells, with some headlines warning of a potential “tourism collapse.”

The latest Central Statics Office reports that 654,500 foreign visitors travelled to Ireland in June 2025, down 2.2pc on June 2024 and 38.4pc on pre-pandemic.

This compares with drops of 25pc in January, 29.8pc in February, 15.4pc in march, 3.8pc in April and 9.9pc in May. Compared with pre-pandemic inbound figures are down 48pc in January, 48.5pc in February, 43.8pc in March, 43.7pc in April, 45.1pc in May and 38.4pc in June.

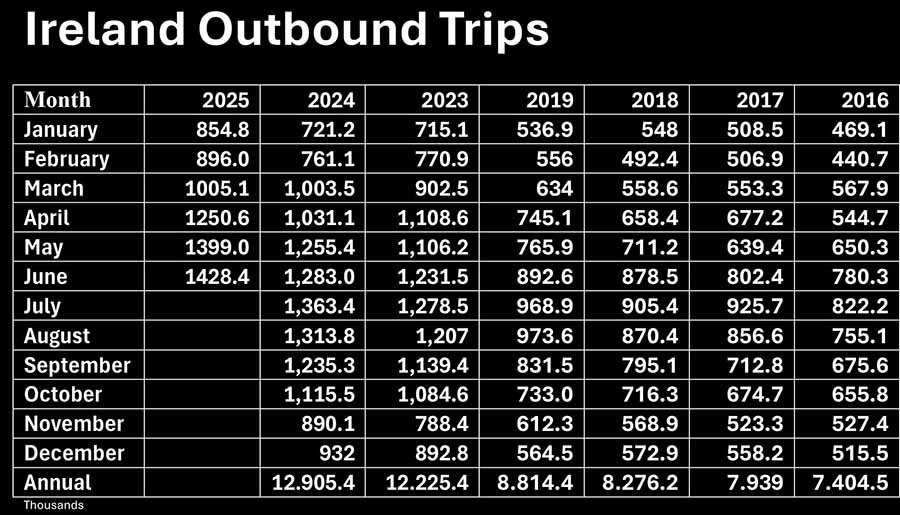

However, industry leaders and tourism bodies, including Fáilte Ireland and the Irish Tourism Industry Confederation (ITIC), have challenged the severity of these declines, arguing that the data does not align with their on-the-ground experiences. A report commissioned for ITIC noted that, while overall figures aligned closed to airport data, the proportion of inbound to outbound changed dramatically with the new methodology.

The CSO’s methodology, which relies on passenger surveys conducted at Irish airports and seaports, has come under scrutiny. The series, introduced during the Covid-19 period, uses a different approach from the previous Overseas and Tourism and Travel Series, making direct comparisons with pre-2020 data challenging.

For instance, the United Nations World Tourism Organisation, using CSO-derived figures, reported a decline in international tourists from 10.961m in 2019 to 6.3m in 2023, a drop that has fuelled debate about the accuracy of current statistics. Industry stakeholders argue that hotel occupancy rates, visitor attraction figures, and regional airport growth tell a more positive story, with 51pc of tourism businesses reporting revenue decreases in 2025, yet North American visitor numbers showing resilience, particularly in June when 654,500 foreign visitors arrived, a 6pc increase from 2023. The mix of visitors has changed radically, Britain still providing the most visitors but down to 34pc of overall market share compared with 31pc from North America and 30pc from Europe.

Tourism Ireland’s chief executive, Alice Mansergh, has expressed cautious optimism and stopped responded to the monthly figures, citing increased air access following the suspension of the Dublin Airport passenger cap as a potential boost for 2025. She acknowledged risks posed by geopolitical turbulence and macroeconomic uncertainties, such as economic challenges in England and political instability in the US. The ITIC has highlighted capacity constraints, including the use of tourism properties for housing refugees and new short-term letting legislation, as significant hurdles to growth. Meanwhile, the CSO defends its methodology, describing it as “consistent and robust” and independently reviewed, with plans to meet tourism bodies to address discrepancies.

The figures also show a shift in the order of source markets: Canada and the United States are now 30.1pc of total arrivals, while Britain is down to 34.2pc and mainland Europe 30.7pc.

While the CSO reports a 6pc drop in visitor spending in June 2025 compared to 2024, despite a 6pc rise in nights spent, industry leaders argue that the sector remains a cornerstone of Ireland’s economy, contributing 20.4pc to GDP in 2024. As discussions continue, the focus is shifting towards balancing source markets, enhancing business event strategies, and addressing cost-of-living pressures to maintain Ireland’s appeal as a leading holiday destination.

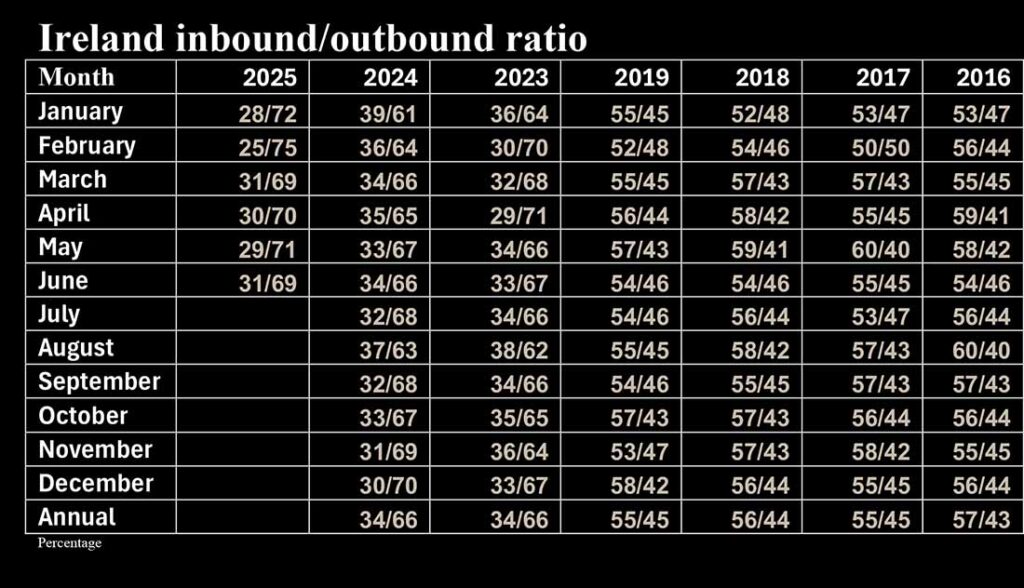

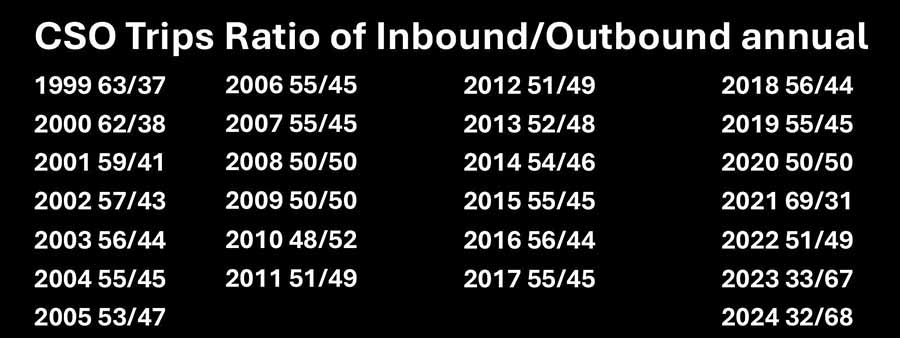

Crucially, the ratio of inbound to outbound has been transformed suggesting wither that (1) booking patterns have changed dramatically or (2) previously, inbound passengers were being overcounted and the outbound passengers were being undercounted. The inbound/outbound ratio in June was calculated at 31/69. In June 2017 it was calculated at 55/45 and the previous month we were told it was 60/40. Historically the annual figures for the 1990s regularly suggested that more than 60pc of the total traffic on and of the island consistent of inbound visitors and less than 40pc of outbound trips by irish residents. Figures may have been miscounted for years, if not decades.