Aer Lingus reported an operating profit of €205m for the financial year 2024, down 8.9pc from €225m in 2023 and hit by a €55m charge from the summer pilot’s strike. Without the strike, profits would likely be up by around 15.6pc.

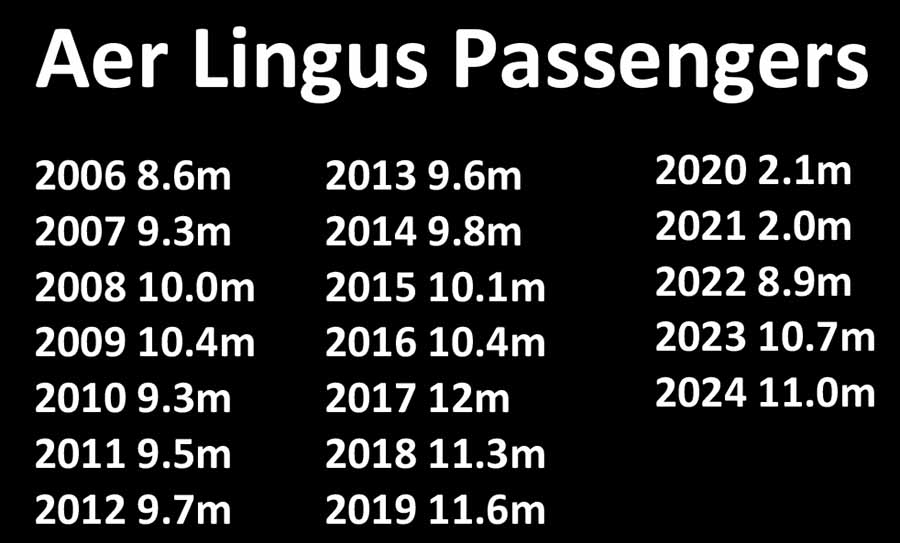

The airline carried 11,018k passengers in 2024, up 2.6pc from 10,743k the previous year and down 5.2pc from pre-pandemic. The airline is back to 94.8pc of pre pandemic levels.

Load factor was flat at 80.5pc compared with 80.6pc in 2023. Passenger revenue was up 4.4pc to 2,291, an average of €210 per passenger.

A written statement this morning outlined Aer LIngus investment in 2024 including new aircraft, expanding its North American routes, upgrades to customer facilities, and technology enhancements to improve the customer experience. Aer Lingus will be updating its onboard product including a new business and new premium economy seat from winter 2026

Aer Lingus increased its use of Sustainable Aviation Fuel in 2024, aiming for 10pc usage by 2030. Aer Lingus RPK is the lowest in the group, 26,317 compared with 38,804 for Vueling, 75,408 for Iberia and 149,156 for British Airways.

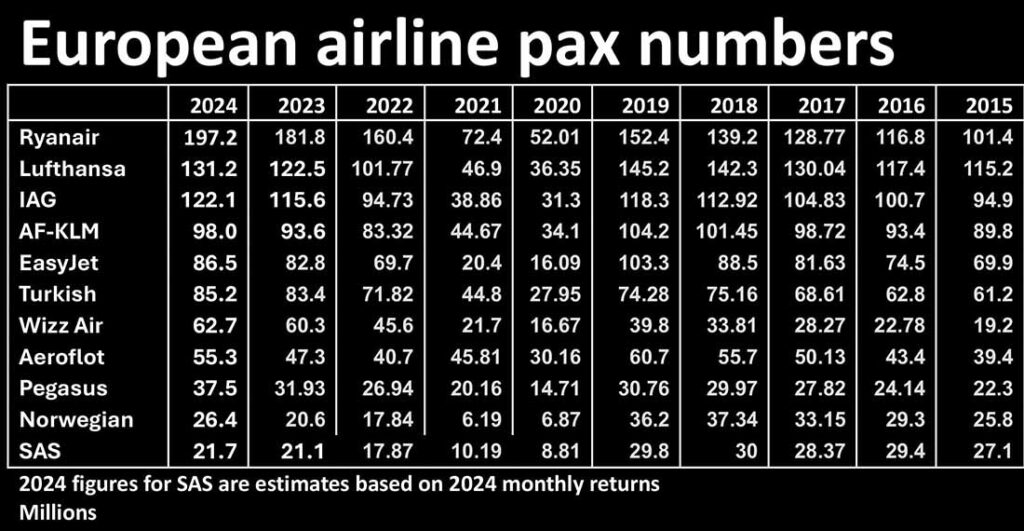

Aer Lingus parent IAG posted adjusted operating profit of €4.44bn, above analysts’ expectations from a company-compiled poll for €4.08bn. The group of five airlines carried a combined total of 122.1m passengers in 2024, making it Europe’s third largest after Ryanair and Lufthansa.

A regulatory statement from IAG shared: Aer Lingus will continue to focus on building Dublin as a gateway to the USA, leveraging its geographic and cultural ties, as well as providing a competitive European network. Aer Lingus’s focus is on building the brand in key North American gateways. It is building a new flagship lounge at JFK Terminal 6, which will facilitate onward connections. Other lounges at Boston, Chicago and San Francisco have been updated. 99pc of eligible TSA pre-check customers take less than 10 minutes at relevant airports.

Aer Lingus is an increasingly digital and data-driven organisation. Aer Lingus has new app-based capabilities, providing real-time flight status, boarding gate notifications and a new ‘manage bags’ feature. Aer Lingus contact centre initiatives have included interactive voice recognition and speech and text analytics which have contributed to increasing the automation rate by 30% and has reduced average handling times. Payment can also now be taken in the chat channel.

The addition of the A321XLR to Aer Lingus’s fleets will add to their customer offerings, allowing them to fly profitably throughout the year to more seasonal destinations, as well as to add frequencies where it would reinforce their schedules. It will also allow existing widebody capacity to be redeployed to other markets. We have seen ongoing strong demand for travel throughout 2024 and now into 2025, particularly across our core markets. Leisure travel remains robust as a major priority for households and in recent years we have seen this boosted by a shift as customers value experiences over material purchases. In addition, in the VFR segment (‘Visiting Friends and Relatives’), Globalisation has created resilient, reliable demand to both ends of the route network. Corporate travel increased through the year, although we estimate that it will not fully recover to pre-COVID 19 levels, particularly for short duration and short-haul trips. Long haul now represents 34pc of IAG’s total capacity.

Aer Lingus’s CEO, Lynne Embleton shared, “These results, and in particular the positive performance in Quarter 4 2024, demonstrate underlying momentum within the business. With additional A321 XLRs joining our fleet, Aer Lingus has a compelling growth ambition that will benefit the airline, our customers, our employees and the economy. We remain focussed on continually improving our efficiency and productivity in order to further invest in growth, enhanced customer experience and sustainability. We welcome the clear commitment in the programme for Government to address the passenger cap issue – it is critical that the Government urgently implements a solution that gives the longer-term certainty that is needed.

“The summer results were impacted by the industrial action, but what I think we see here is momentum in the business. If we exclude the industrial action we were up on 2023, quite significantly, we were really strong on quarter 4, bookings were coming in really well and we’ve extended our network into the winter with new sun routes to Marrakesh, Malta, Seville and the big one, Las Vegas.”

The fares we’ve had, have been very competitive. There has been a lot of capacity that has come into the market, particularly on the North Atlantic routes, and we’ve been competing strongly as we always do, but you see the impact in the financial results.”

The pay agreement with our cabin crew and ground staff goes through to the end of 2025 so in due course we will be starting conversations with them. They’ will absolutely get a pay increase, yes.”

“It is well established that the value of aviation to the economy and to jobs is well understood now, and this passenger cap needs to be resolved on a permanent basis. The idea that we built a new runway, costing over €300m, and there is a consultation to reduce the number of prime time movements down from 110 on average per night to just over 30 would have a devasting impact on the operating of the hub, the timing of flights for business travel, indeed our ability as an airline to drive efficiency out of the aircraft assets.”

“This is a topic which is still not resolved. It is not as prominent in people’s minds as the passenger cap but it is one that is quite critical to functioning national infrastructure at the airport. With additional A321 XLRs joining our fleet, Aer Lingus has a compelling growth ambition that will benefit the airline, our customers, our employees and the economy.“