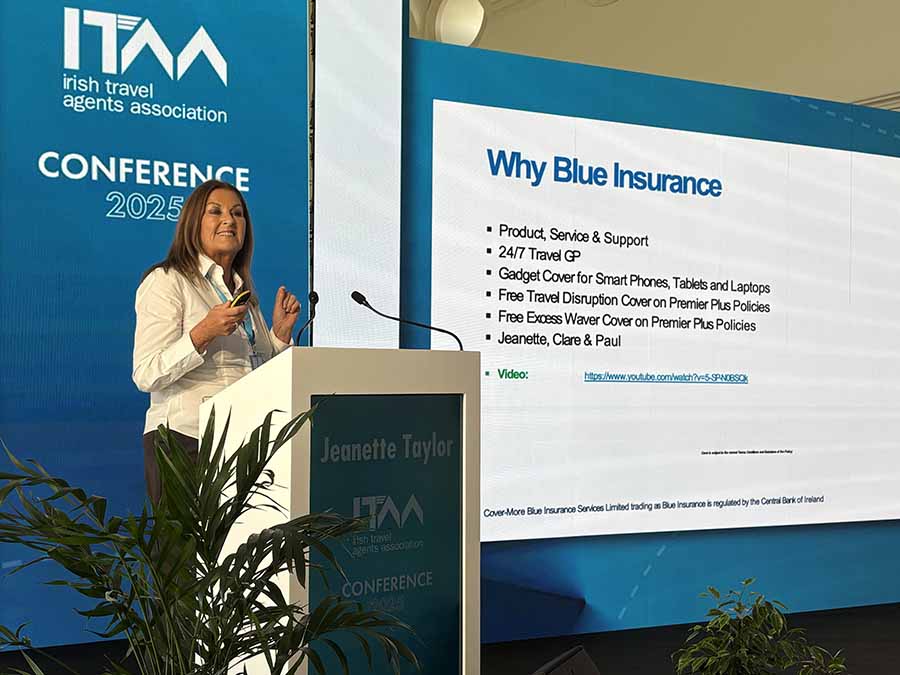

Jeanette Taylor

Travel insurance provides financial protection against medical emergencies, trip cancellations, lost baggage, delays, and personal liability claims. Customers value this cover more as living costs rise and holidays represent larger investments. Policies now include access to 24/7 online GP consultations, a service launched in 2025 that received positive feedback during periods of high summer temperatures in Mediterranean destinations.

Jeanette Taylor told the annual conference of the Irish Travel Agents Association in Alcobaca in Portugal that Blue Insurance offers optional gadget cover for smartphones, tablets, and laptops, with claims often exceeding €1,000 for items left on aircraft during Lapland trips. Premier Plus policies include free cancellation cover for scheduled airline failure and free excess waiver.

The company operates a 24/7 emergency assistance line and processes claims through a dedicated travel trade team. Delegates at the conference received complimentary general insurance cover provided by Blue Insurance. Free scheduled airline failure protection and excess waiver feature on higher-tier policies, addressing risks from air traffic control disruption and carrier insolvency.

Agents received a reminder to sell travel insurance at the point of booking the holiday rather than later. This practice ensures immediate cover for cancellation and avoids gaps if customers face issues before departure.

Key takeaways include the growing customer demand for medical and cancellation protection, the value of add-on gadget cover for family trips, and the importance of purchasing insurance at booking stage.

“It offers protection if you accidentally cause injury or damage to others while travelling. We’ve had great feedback on… our 24/7 GP… they were able to pick up their phone and… we were able to direct them to an online doctor straight away. The importance of booking travel insurance at the time of booking.”