Air France-KLM is considering implementing a strategy similar to its SAS acquisition for TAP Air Portugal, contingent on suitable conditions as stated by CEO Ben Smith at their annual press conference.

The group currently holds a 27.98% stake from the French government and 9.13% from the Dutch government, providing advantages over privately owned competitors amid ongoing discussions of TAP’s privatisation.

Smith expressed concerns regarding the European Commission’s competition policy, claiming it weakens European airlines against global counterparts and advocated for more favourable merger conditions in Europe.

Despite the political crisis in Portugal and potential early elections in May that could impact the privatisation timeline, Air France-KLM is cautious and will only invest in TAP within their comfort zone.

The group has cultivated a cooperative relationship with both the French and Dutch governments, positioning itself favourably in discussions with the Portuguese government regarding the future of TAP Air Portugal.

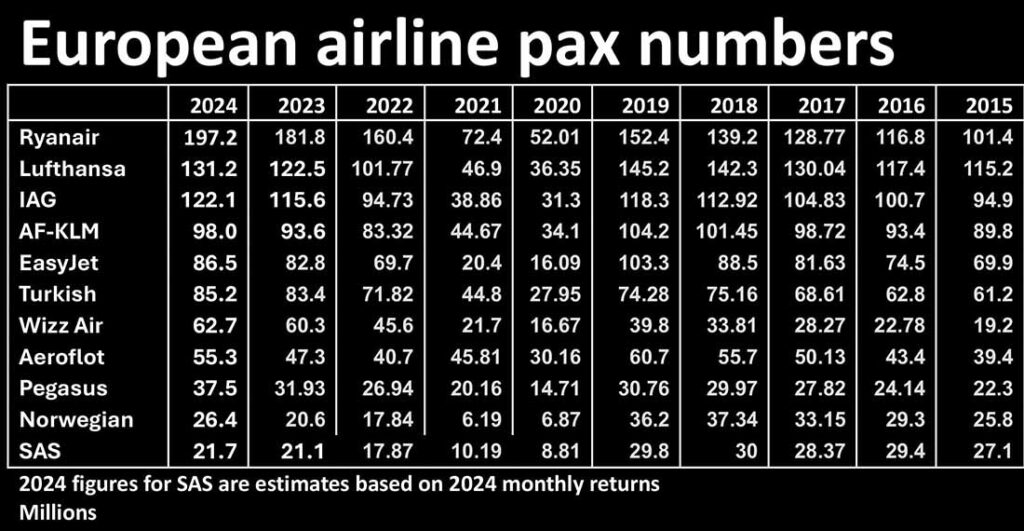

The takeovers of SAS and TAP would bring the Air France Group ton 135m passengers, placing it third behind Ryanair and the Lufthansa group after acquisition of ITA.