IAG’s annual report for Aer Lingus to year end 2023 reports a 20pc increase in capacity in terms of Available Seat Kilometres (ASKs), with the network restored at the beginning of the year.

Passenger numbers grew by 20pc to approximately 10.8m, with higher load factors and a 10pc increase in passenger unit revenue contributing to a positive passenger revenue performance of €2.087m. Total operating costs increased by 19pc in the year.

According to the report:

- The Company had a strong return to profitability in 2023 with an Operating Profit of €219m (2022: €50m) and an operating margin of 10pc (2022: 3pc).

- Capacity was increased by 20pc (measured in Available Seat Kilometres (ASKs)) from 2022 with the continued restoration of the network at the beginning of the year and the addition of new routes.

- Launched the Cleveland route and recommenced the Bradley route.

- Shorthaul routes to Olbia, Kos and Brindisi were added.

- Aer Lingus carried circa 10.8m passengers in the year, an increase of 20pc from last year, with a higher passenger load factor of 5 points.

- Passenger unit revenue also increased by 10pc reflecting the higher yields across the network. These factors contributed to a positive passenger revenue performance of €2.087m, an improvement of 32pc.

- Cargo revenue decreased versus last year on foot of increased capacity in the market.

- Total operating costs in the year were €1,928m, an increase of 19pc with an improvement of 2pc in unit costs/operating cost per ASK.

- The highly regulated and commercially competitive environment, together with Aer Lingus Limited’s operations, exposes the Company to risks, where its ability to influence and directly manage the risks may be limited. Examples include aircraft, engine, and component availability, the wider ongoing fundamental weaknesses in the resilience of the aviation sector’s supply chain; air traffic control (ATC) resilience and policy measures taken by governments to address the economic environment or policy proposals that could impact Aer Lingus’ ability to set capacity and/or competitive pricing.

- Other external threats that remain heightened include: the impact of inflation and interest rates on demand and customer confidence; higher costs in the supply chain.

- Another risk is the potential delays to delivery of infrastructure at Dublin Airport and the imposition of operating restrictions that could impact scheduled operations and cap overall annual numbers of passengers.

- The number of headcount employed as part of the Company’s trade rose by circa 900 in the year, in line with capacity growth. Unit costs improved by 1pc due to management initiatives offsetting pay increases.

- Fuel and supplier costs rose by circa 20pc in 2023, primarily due to higher activity. The Company hedges its fuel purchases in advance, typically building its cover over two years. This hedging programme smooths the effects of rising (or falling) prices as evidenced by the blended average fuel price per metric tonne in 2023 being flat versus last year (2023: $870; 2022: $869).

- On a unit basis, fuel costs were 2pc better. Supplier costs were impacted by inflation and volatility in international supply chains.

- Capital expenditure for the financial period was €252m (2022: €133m), primarily reflecting the delivery of two aircraft in the period and aircraft pre-delivery payments.

- Other items included in capital expenditure are maintenance technical equipment (such as engines and rotable spare parts), in addition to operating and office equipment of €4m (2022: €0.2m). €65m (2022: €39m) was invested acquiring intangible assets such as licences, software and carbon credits for emissions trading schemes.

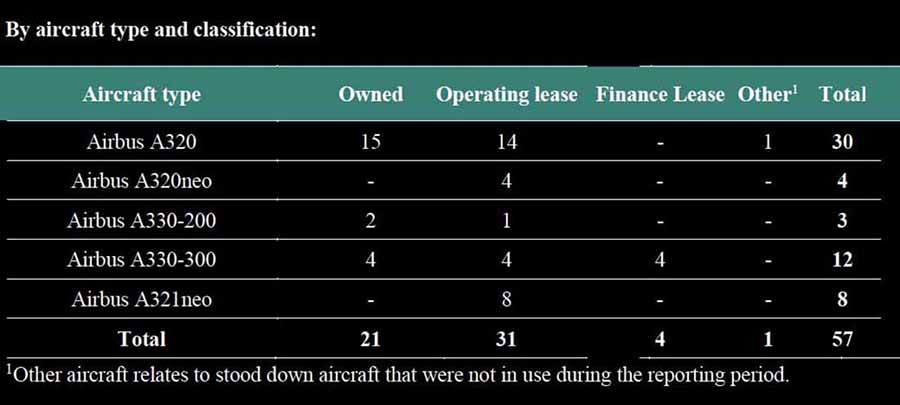

- As at 31 December 2023 there were 57 aircraft in service (2022: 56). During the reporting period, three A330-200 aircraft returned to active service. One aircraft in storage was stood down during the year.

- Of the three aircraft which returned to service, two are owned assets and one is on an operating lease. Additionally, four A320 aircraft which were previously on finance leases were reclassified as owned aircraft during the reporting period.

https://www.iairgroup.com/investors-and-shareholders/financial-reporting/annual-reports/