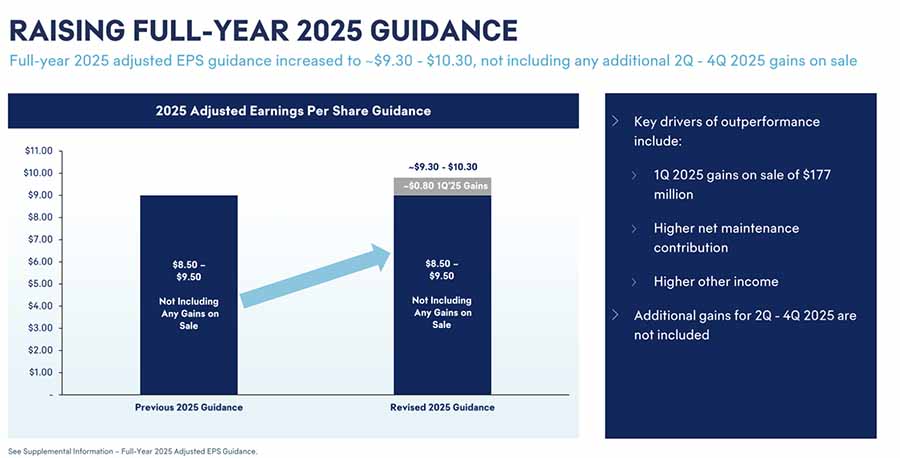

AerCap Holdings N.V. has raised its guidance for 2025 from 8.50./9.50 to 9.30/10.30 after a storng first quarter, driven by gains on sale of $177 m, and higher net maintenance contribution. The company reported a net income of $643m for Q1 2025, equating to $3.48 per share.

The company raised its full-year adjusted earnings per share guidance to a range of $9.30 to $10.30, excluding further gains from asset sales.

As of March 31, 2025, AerCap’s portfolio consisted of 3,508 aircraft, engines and helicopters that were owned, on order or managed. The average age of the company’s owned aircraft fleet as of March 31, 2025 was 7.5 years (4.9 years for new technology aircraft, 15.2 years for current technology aircraft) and the average remaining contracted lease term was 7.3 years.

A new share repurchase programme of $500m was introduced alongside strong financial results.

The effective tax rate for AerCap was 15.5pc in Q1 2025, which marked an increase from the previous year’s 14.3pc.

Key metrics included a return on equity of 15pc, adjusted return on equity of 16pc, and operating cash flow of $1.3bn for the first quarter of 2025. Shares in the company, which are listed in New York, were trading about 2.7pc higher early yesterday. The stock price of AerCap, which has a market capitalisation of $20bn, have climbed 10pc in the year to date and by 22pc in the past 12 months

Gus Kelly shared during the earnings call that he hoped the 1979 zero tariff agreement between Europe and the USA could be extended to other countries, including India and China. The USA. has a massive trade surplus in aerospace with the rest of the world. It’s high-tech engineering, manufacturing, great paying jobs. And I think to expand the potential for that would be a tremendous achievement by the administration, if it could be done to bring in those other countries into that zero-tariff agreement:

AerCap produced another strong performance for the first quarter of 2025. We continue to benefit from strong demand for our aviation assets, as well as a robust sales market. Our airline customers around the world remain focused on locking-in capacity, despite the ongoing uncertainty regarding tariffs and trade. This is evidenced by our 99% utilization rate and 84% extension rate in the period.

On the passenger aircraft side, we continue to see strong bids for our assets, with a couple of notable deals on the 787s in particular. There, we are seeing strong demand both for remarketing aircraft, and a broadening of the user base.”

- Basic lease rents amounted to $1,649m, negatively affected by $27m in lease premium amortisation.

- Maintenance rents and other receipts totalled $146m, with a negative impact of $9m from maintenance rights assets amortised to revenue.

- The net gain on the sale of assets was $177m, reflecting a 35pc unlevered gain-on-sale margin, or 2.3 times the book value on an equity basis.

- Other income reached $105m, primarily consisting of interest income.

- Interest expense was $503m, which included $5m related to non-cash mark-to-market losses on interest rate derivatives.

- Leasing expenses totalled $81m, including $7m in maintenance rights amortisation expenses.

- Income tax expense was $111m, resulting in an effective tax rate of 15.5pc.