Ryanair’s decision to change its dividend policy and will pay out a €400m dividend is unusual in the airline’s history, and has caused the stock to soar 20pc in the days since the summer results were issued.

This demonstrates the company’s confidence in its ability to generate cash and its commitment to distributing earnings to shareholders.

Shares have rallied in just one week and analysts remaining optimistic about its future growth potential.

While some concerns exist regarding the short-haul model and the capacity for fare increases, Ryanair is still considered the standout in the short-haul sector.

The Irish airline, experienced a series of challenges including the impact of COVID-19, the Russia-Ukraine conflict, surging energy costs, and industrial unrest. These factors caused its share price to decline, reaching around €10.50 by September 2022.

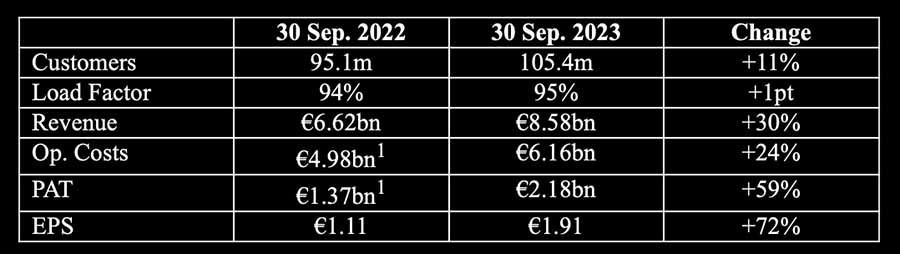

This week’s half-year results were exceptional. The company saw an 11pc increase in traffic, revenue per passenger rose by 17pc, and reported half-year profits of €2.18 billion, up 59pc on the previous year.

Full Ryanair H1 Report:

- Ryanair reports strong half year profits of €2.18bn

- Due to record summer traffic

- Full year pat of €10 per pax likely – €400m div. Declared

Ryanair Holdings today (6 Nov.) reported a strong half-year profit of €2.18bn, compared to a prior year H1 PAT of €1.37bn, thanks to a strong Easter in Q1, record summer traffic and higher fares which offset significantly higher fuel costs in the half year.

H1 highlights:

- Traffic grew 11pc to 105.4m (95pc load factor).

- Rev. per pax +17pc (ave. fares +24pc & ancil. rev. +3pc).

- 3 new bases & 194 new routes in S.23.

- 124x B737 “Gamechangers”. Total fleet of 563 aircraft at 30 Sep.

- Fuel bill rose €0.6bn (+29pc) to €2.8bn.

- Fuel hedging extended – c.85pc FY24 at $89bbl & over 50pc FY25 at $79bbl.

- Net cash of €0.84bn (31 Mar. €0.56bn), over €1bn debt repaid.

- 300x Boeing MAX-10 order underpins growth decade to 300m pax p.a. by FY34.

- €400m maiden div. & div. policy announced.

Social:

We expect to create over 10,000 new, well-paid, jobs for highly trained aviation professionals as the Group expands our fleet to 800 aircraft by FY34. Building on the success of our aviation training facilities in Dublin, Stansted, Bergamo and East Midlands, we’re opening 2 new excellence centres in Krakow and Madrid to accelerate local crew training and development in those major markets. Our recently announced engineering academy will support 1,000 apprentices annually as we train the next generation of highly skilled mechanics and engineers. Ryanair Labs is also growing at its dev. hubs in Dublin, Madrid, Portugal and Wroclaw to support Ryanair’s customer service, our efficiency and scalability over the coming decade.

Ryanair’s investment in resilience ahead of our S.23 schedule (increased crew ratios, doubling the capacity of our Dublin and Warsaw ops centres, enhanced day-of-travel app. and continuously improving live customer comms.) ensured that our passengers and crews could enjoy Ryanair’s industry leading OTP and reliability, despite significant ATC disruptions this year. This is reflected in our strong H1 CSAT score of 84pc, notwithstanding over 60 days of French ATC strikes.

Growth & Fleet

During S.23 we operated our largest ever schedule, including 3 new bases and over 190 new routes. We delivered record traffic across peak summer months. This winter we’ll operate 6 new bases (Athens, Belfast, Copenhagen, Girona, Lanzarote & Tenerife), and over 60 new routes including our first 17 routes to Albania. To date over 90pc of S.24 capacity is already on sale, including over 180 new routes.

While Boeing are currently suffering delivery delays with Spirit (their fuselage supplier), we are working with them to minimise delays ahead of peak S.24. At this stage, we are concerned that up to 10 of our 57 contracted Gamechanger deliveries pre S.24 may be delayed until winter 2024.

We expect European airlines will continue to consolidate over the next 2-3 years, with the takeover of ITA (Italy) and the sale of TAP (Portugal) and SAS (Scandinavia) already underway. While Pratt & Whitney engine (GTF) issues and inspection programme threaten to substantially curtail competitor and lessor capacity between 2024 and 2026, the large backlog of OEM aircraft deliveries is also likely to constrain capacity in Europe for the next 3 or 4 years. These capacity constraints, combined with our widening cost advantage, our judicious fuel hedging, strong balance sheet, low-cost aircraft orders and industry leading operational resilience, creates significant traffic and profit growth opportunities for Ryanair as we expand to carry 300m pax p.a. by FY34.

H1 FY24 BUSINESS REVIEW:

Revenue & Costs

H1 scheduled revenues increased 37pc to €6.1bn. Traffic grew 11pc to 105.4m while ave. fares rose 24pc to c.€58 due to a strong Easter and record S.23 demand. Ancillary revenue increased 14pc to €2.5bn (c.€23.70 per passenger). Total H1 FY24 revenue therefore rose 30pc to €8.6bn. Total operating costs increased 24pc to €6.2bn, primarily due to much higher fuel costs (+29pc to €2.8bn), higher staff costs (reflecting pay restoration, pre-agreed pay increases and higher crewing ratios as we invested in ops. resilience) and higher ATC fees (incl. airport & handling charges). Ryanair’s cost advantage over most of its EU competitors continues to widen, with H1 ex-fuel unit costs finishing just under €32.

Our FY24 fuel requirements are almost 85pc hedged at approx. $89bbl (a mix of forwards and caps) while our FY25 hedging has increased to just over 50pc at approx. $79bbl. This will deliver savings of approx. €300m on the fuel already hedged for FY25. Over 90pc of FY24 €/$ opex is hedged at 1.08 and almost 50pc of FY25 is hedged at 1.12. This strong hedge position leaves us very well protected from recent short term fuel price volatility which many competitors are more, or fully, exposed to.

Balance Sheet & Liquidity

Ryanair’s balance sheet remains one of the strongest in the industry with a BBB+ credit rating (both S&P and Fitch) and over €3.6bn gross cash at period end, despite €1.6bn capex and over €1bn debt repayments (incl. a maturing €750m bond & €260m prepayment of our RCF in Aug.). Net cash was €0.84bn at 30 Sep. (€0.56bn at 31 Mar.). All of the Group’s owned B737 fleet (534 aircraft) are unencumbered, which significantly widens our cost advantage over competitor airlines who are heavily exposed to rising interest rates and rising aircraft lease costs.

Capital Allocation Policy:

Our Board’s strategy, as our business recovered from Covid, was to firstly prioritise pay restoration and multi-year pay increases for our people, something that has now been delivered over recent quarters. Secondly, we are determined to pay down our remaining debt as it matures between now and 2026. Closely aligned to this is the Group’s policy to prioritise growth opportunities to drive shareholder value. This is achieved by maintaining a strong balance sheet and investment grade rating; investing in growth (the Gamechanger and MAX-10 orderbooks will deliver annual traffic of 300m by FY34) from internally generated cashflows; and shareholder returns. Ryanair has an established track record of delivering industry leading returns to shareholders. Between FY08 and FY20 we returned €6.74bn to shareholders via share buybacks and special dividends.

Dividend Policy:

Ryanair’s shareholders invested €400m in a share placing during the peak of the Covid crisis in Sep. 2020, which was key to Ryanair subsequently issuing a timely, low cost, €850m bond, which helped the Group emerge from the Covid pandemic in a position of unrivalled strategic and financial strength. The Board is therefore pleased to declare a maiden ordinary dividend of €400m (c.€0.35 per share) in aggregate through an interim and final dividend of €200m each, payable in Feb. 2024 and after the AGM in Sep. 2024 respectively.

For subsequent financial years (i.e. for FY25 onwards), under the Group’s new dividend policy, Ryanair plans to return approx. 25pc of prior-year PAT (adjusted for non-recurring gains or losses) by way of ordinary dividend to our shareholders. Additionally, the Board, taking into account prevailing market conditions and ensuring that the Group retains a prudent level of cash to fund debt and capex requirements will retain the flexibility to consider, when or if appropriate, the return of surplus cash to shareholders through special dividends and/or share buybacks.

Outlook:

We continue to target approx. 183.5m (+9pc) FY24 traffic, although the final figure depends on Boeing meeting their delivery commitments between now and year-end. As previously guided, we expect ex-fuel unit costs to increase by c.€2 this year, which still widens the cost gap between Ryanair and competitor airlines in Europe. Forward bookings (both traffic and fares) are robust over the late Oct. mid-terms and into the peak Christmas travel period. With the benefit of constrained EU capacity this winter (Eurocontrol expect EU capacity to recover to only 94pc of pre-Covid) and the impact of P&W engine repairs on competitor fleets, we currently expect Q3 ave. fares to be ahead of the prior year Q3 by a mid teens percentage. Unhedged fuel costs, however, are significantly higher making it unlikely that we’ll replicate last year’s bumper Q3 performance. As is normal at this time of year, we have very limited Q4 visibility. Q4 is traditionally our weakest quarter and, this year, will be impacted by the partial unwind of free ETS carbon credits (from Jan. 2024).

This guidance remains highly dependent on the absence of any unforeseen adverse events (for example such as Ukraine or Gaza) between now and the end of Mar. 2024.”