In a dramatic twist that has sent shockwaves through the aviation sector, Spirit Airlines, the brash pioneer of no-frills flying with its iconic fleet of bright yellow Airbus jets, has filed for Chapter 11 bankruptcy protection for the second time in less than a year.

The filing, lodged in the U.S. Bankruptcy Court for the Southern District of New York on Friday, comes just five months after the carrier emerged from its previous restructuring in March, raising fresh doubts about the long-term survival of America’s largest ultra-low-cost airline. Of the airlines fleet of 158 aircraft, about 30 are leased out of Ireland. Factors included:

- The airline’s focus on East Coast markets and domestic services has left it vulnerable to competition from other low-cost carriers and a slowdown in leisure travel.

- Rapid expansion increased the number of airport pairs served to 430, but resulted in low-frequency services that undermine operational efficiency.

- Over 85pc of Spirit’s capacity is dedicated to domestic flights, exacerbating risks amid a cooling market and increased competition from airlines like Frontier.

- Spirit must navigate strategic options to stabilise its operations while facing tougher market conditions and scrutiny on its long-term viability.

With assets and liabilities estimated between €920m and €9.2bn, Spirit’s executives insist the move is a “proactive step” to slash costs by hundreds of millions of euro annually and reposition the company for a sustainable future, but industry watchers warn it could spell the end for the budget behemoth unless a merger or radical overhaul materialises.

The Florida-based airline, which began life in 1964 as a long-haul trucking firm before pivoting to aviation in the 1980s, has long been synonymous with rock-bottom fares and a barrage of ancillary fees for everything from carry-on bags to seat selection. Yet, post-pandemic shifts in traveller preferences towards more comfortable, premium experiences have battered its model, compounded by a glut of domestic flights, engine recalls grounding dozens of aircraft, and failed merger attempts with rivals JetBlue and Frontier.

Spirit’s first foray into Chapter 11 last November – the first for a major U.S. carrier since 2011 – saw it convert €730m in debt to equity and secure €320m in fresh investment, but the airline emerged into a harsher environment of softening U.S. leisure demand and persistent high costs. By the end of June, it had posted a €226m net loss since exiting protection, with operating expenses at €1.1bn – 118pc of quarterly revenue – far outstripping forecasts of a €230m profit for the year.

This latest bankruptcy, dubbed “Chapter 22” by restructuring experts, is poised to be more aggressive. Spirit vows to use the court-supervised process to redesign its route network, shrink its fleet to match subdued demand, and renegotiate aircraft leases and labour contracts, potentially saving hundreds of millions of euro in annual outgoings. Flights will continue uninterrupted, tickets, credits, and loyalty points remain valid, and employees will receive their wages, the company assured in an open letter to customers.

Chief Executive Dave Davis, who took the helm in April, described the previous restructuring as too narrowly focused on debt reduction, stating: “It has become clear that there is much more work to be done and many more tools are available to best position Spirit for the future.” The airline has borrowed the full €253m from its revolving credit facility and is in talks with lessors and debtholders, amid reports that aircraft owners have already approached rivals to offload up to 200 Airbus jets.

Prospects for Spirit’s revival appear dim without external intervention. Analysts at Fitch Ratings, which downgraded the carrier last week, highlight its failure to tackle bloated costs in the first bankruptcy, leaving it vulnerable to a liquidity crunch exacerbated by President Donald Trump’s tariffs and budget cuts cooling consumer spending.

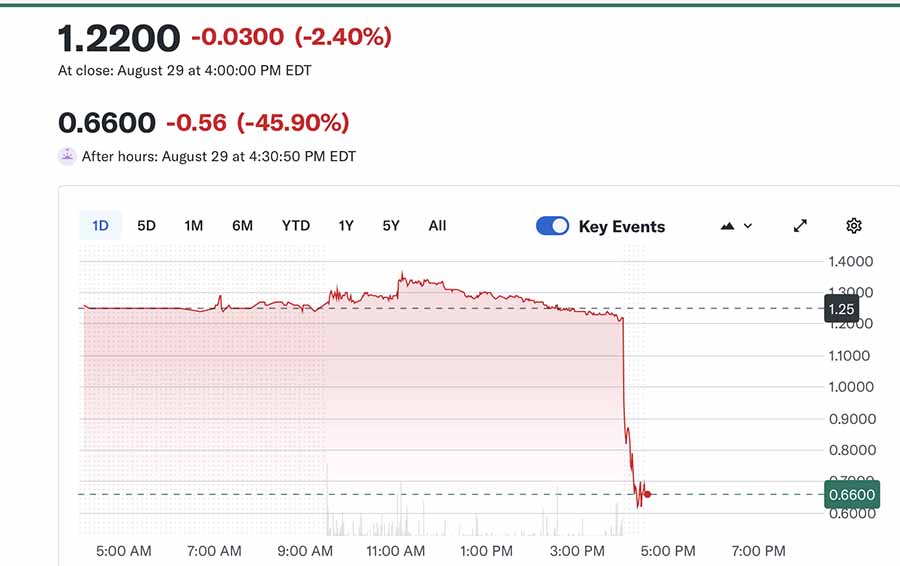

The airline’s shares plummeted 45pc in after-hours trading to around €0.55, with delisting from the NYSE American imminent and common stock likely to be cancelled as worthless. While Spirit eyes a pivot to premium offerings – bundling perks like extra legroom seats and Wi-Fi to lure higher-spending passengers – sceptics question whether it can compete with larger carriers like Delta and United, which have poached budget travellers with their own basic economy fares backed by global networks. “Spirit’s troubles stem from not fixing its cost structure last time; this could be harder,” said Joe Rohlena of Fitch, noting the carrier’s negative free cash flow of €920m by June’s end.

Cost-cutting measures implemented since March have been severe but insufficient. The airline furloughed 270 pilots and demoted 140 captains to first officers effective October and November, following earlier layoffs of 200 staff and the sale of 23 older Airbus aircraft for €477m. It has also deferred Airbus deliveries from mid-2025 to 2030-2031, boosting liquidity by €313m over two years, and cut capacity by 24pc for May and June – slashing over 12,000 flights and reducing seats by 1.17m compared to last year.

These moves have hit hubs like Boston (down 44pc), New York LaGuardia (down 39pc), and Los Angeles (down 37pc) hardest, with four U.S. airports losing service entirely. The route network, once spanning 88 destinations across the U.S., Caribbean, Mexico, and Central America with 5,013 weekly flights, faces further contraction: unprofitable markets will be pruned, frequencies reduced on routes like Miami to San Juan (to three weekly from August), and international services to Colombia and Peru axed from July. Yet, Spirit has added 28 new domestic routes from cities like Raleigh-Durham and Nashville starting May, and launched services to Belize City and Grand Cayman from Fort Lauderdale, betting on leisure demand in focus areas.

The fallout on Spirit’s route network could be profound, reshaping budget travel options forms. With 10pc of its seats on monopoly routes, the carrier’s retreat risks fare hikes of 5-22pc on affected paths, per TD Cowen analysis, as competitors like Frontier – which announced 20 overlapping routes this week – swoop in.

Frontier’s CEO Barry Biffle has positioned his airline as the “last man standing” in the ultra-low-cost space, expanding aggressively in Spirit’s Florida and Houston strongholds with fares from €27. Other rivals, including Southwest and United, are eyeing Spirit’s young fleet and valuable slots at congested airports like LaGuardia and Newark for acquisition.

Aviation lessors have already canvassed executives at these carriers about taking over aircraft. Spirit has a fleet of 158 aircraft, 43 of them leased from Aercap, ALC, Avolon, DAE and SMBC among others. AerCap is purchasing 36 Airbus A320neo family aircraft, originally ordered by Spirit Airlines, for lease back to Spirit, with deliveries slated for 2027 and 2028. This deal is part of a larger strategic partnership and a significant highlight in AerCap’s operations, which also included leasing 20 new A320neos to Spirit that began delivery in 2022.

Unions are also braced for pain: the Association of Flight Attendants-CWA warned members of “harder” times ahead, with hundreds already on voluntary leave.

Reactions from aviation rivals and commentators have been a mix of opportunism and cautionary tales. Frontier, long thwarted in merger bids, is aggressively courting Spirit’s customers, with Biffle declaring his airline ready to dominate the budget segment. Larger players like United and American see potential in absorbing assets without antitrust hurdles, given the Trump administration’s lighter touch on deals.

Commentators, however, paint a bleaker picture. “Spirit’s independent future is doubtful; a second bankruptcy carries greater liquidation risk,” said restructuring adviser Nathan Bomey of Axios, echoing Brett Snyder of Cranky Flier, who quipped: “You have no place to sleep if you burn your bed.”

Purdue University’s Volodymyr Bilotkach warned of a “real possibility” of shutdown, noting the carrier’s failure to adapt to premium trends. On the flip side, some hail the filing as a necessary reset, akin to successful Chapter 11 exits by Delta and American, with Scott Keyes of Going.com crediting Spirit for decades of downward pressure on fares: “Even if you never flew them, you owe them for cheaper flights.”

As Spirit navigates this perilous Chapter 22, the aviation world watches closely. Will it emerge leaner and meaner, or fragment into a fire sale of yellow jets? For now, the carrier’s 12,800 employees and loyal budget flyers cling to assurances of continuity, but the road ahead looks as cramped as one of its infamous seats.