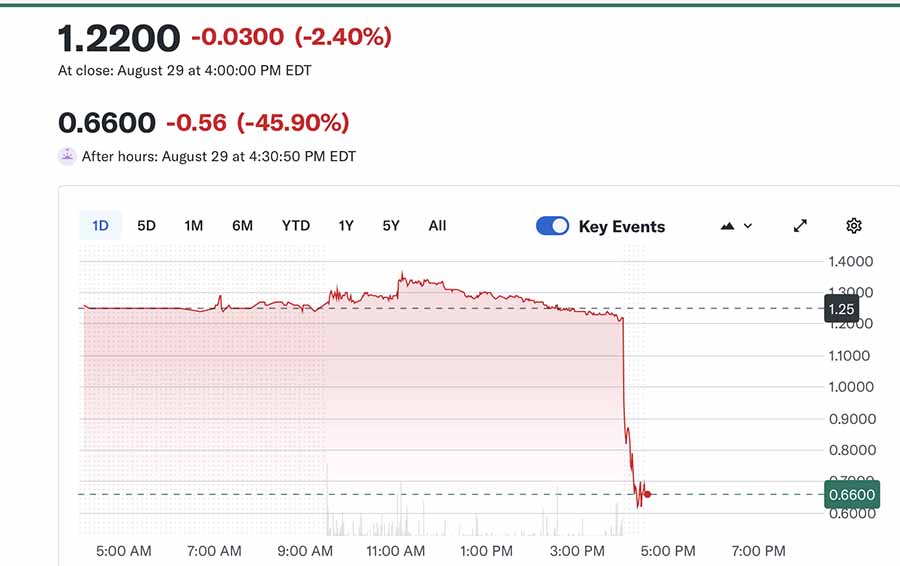

Spirit Aviation Holdings filed for voluntary Chapter 11 restructuring on August 29, 2025, marking its second time in less than a year.

The airline announced that the filing would not affect operations, with all scheduled flights continuing as planned. President and CEO Dave Davis shared that Spirit aims to redesign its network and optimise fleet size through this restructuring.

Spirit Airlines plans to recentre its network on specific cities while expanding its premium product offering. The company is engaging with major lessors and stakeholders during the process to implement a financial and operational transformation. The company’s five largest unsecured creditors are:

- The US Department of Treasury (USD136m);

- Advertising agency Charles Tombras Advertising (USD7.8m);

- Lufthansa Technik (USD5.7m);

- Aerospace Turbine Srvc & Sol LLC (USD1.8m); and

- Microsoft Licencing (USD1.7m).

Spirit has a fleet of 158 aircraft 43 of them leased from Aercap, ALC, Avolon, DAE and SMBC among others.

AerCap is purchasing 36 Airbus A320neo family aircraft, originally ordered by Spirit Airlines, for lease back to Spirit, with deliveries slated for 2027 and 2028. This deal is part of a larger strategic partnership and a significant highlight in AerCap’s operations, which also included leasing 20 new A320neos to Spirit that began delivery in 2022.

Dave Davis shared, “Since emerging from our previous restructuring, it has become clear that there is much more work to be done and many more tools are available to best position Spirit for the future. The Chapter 11 process will provide Spirit the tools, time and flexibility to continue ongoing discussions with all of its lessors, financial creditors and other parties to implement a financial and operational transformation of the company.”

“The filing had no impact on its operations and all scheduled flights will continue as planned. While remaining true to its original mission of making travel more accessible for everyone.”