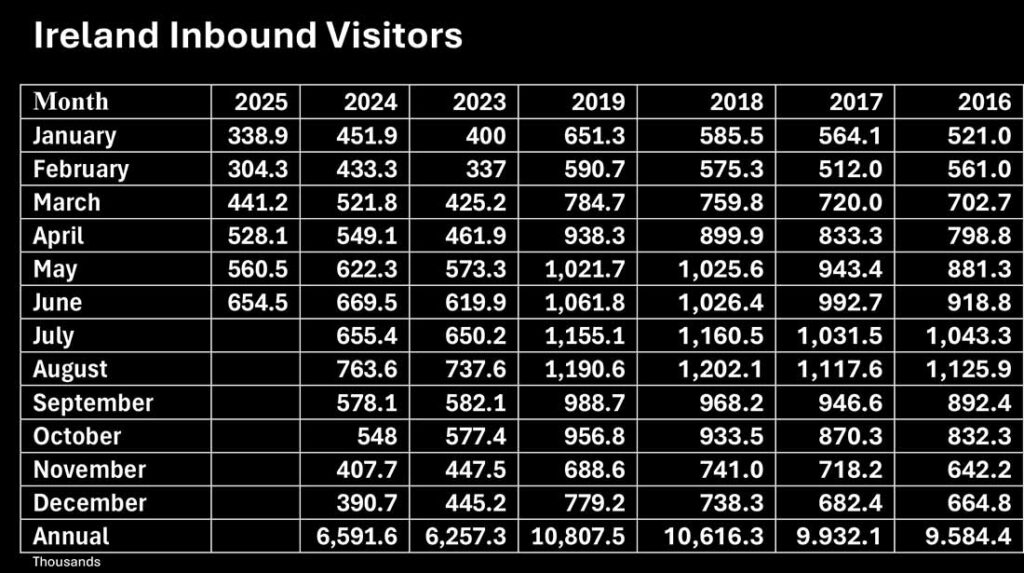

The Central Statics Office reports that 654,500 foreign visitors travelled to Ireland in June 2025, down 2.2pc on June 2024 and 38.4pc on pre-pandemic.

This compares with drops of 25pc in January, 29.8pc in February, 15.4pc in march, 3.8pc in April and 9.9pc in May. Compared with pre-pandemic inbound figures are down 48pc in January, 48.5pc in February, 43.8pc in March, 43.7pc in April, 45.1pc in May and 38.4pc in June.

The figure is 6pc ahead of June 2023, the CSO points out in its press release. The CSO has changed its methodology since the pandemic, raising questions over whether figures can meaningfully be compared with 2019 and before.

The average length of stay for these visitors increased to 7.9 nights. Total nights spent in Ireland reached 5.2m, reflecting a 6pc rise from June 2024 and a 14pc increase from June 2023. Visitor spending for June 2025 was €647m, down 6pc from 2024 but up 8pc from 2023.

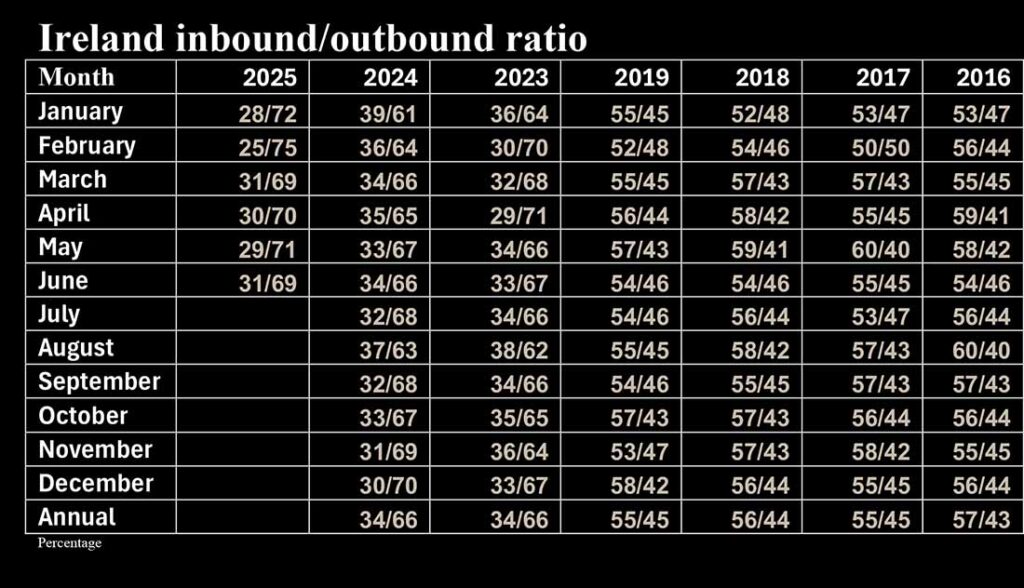

The majority of visitors originated from England, Scotland and Wales (34pc), with North America accounting for 25pc of the total. England was down 1.5pc in June (compared with 46pc in May) and down 39.9pc since pandemic, Europe was down by 5.3pc.

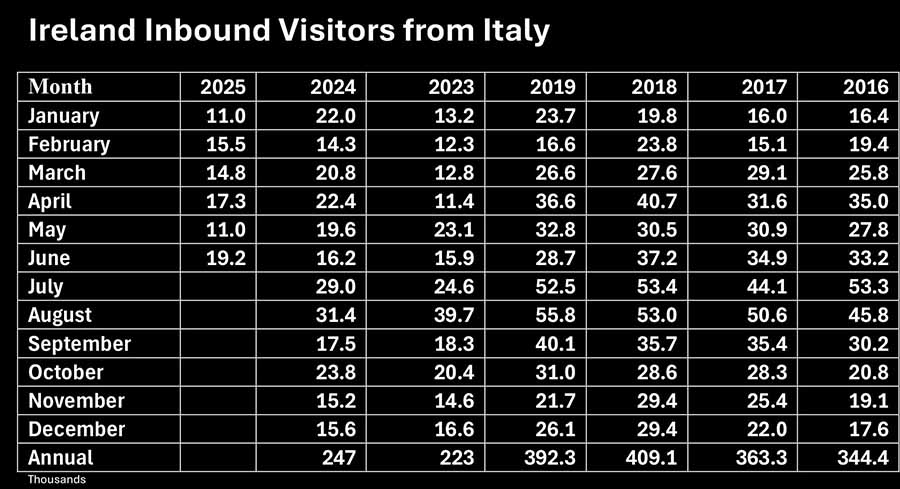

The shining lights in the figures were North America and Germany. Usa and Canada combined were up 4,4pc on 2024 and USA is up 3.5pc, although North America is still down 34.6pc on pre pandemic. Germany was up by 26.3pc, following four months of decline and an increase of 11pc in May. Italy was up 18.5pc and Spain was up 11.7pc. France was down 17.5pc. Australia and New Zealand were up 2.5pc off a low base and down 45.8pc on pre pandemic.

North America is now 30.1pc of the overall inbound market by visitor numbers, with Britain at 34.2pc and Europe at 30.7pc.

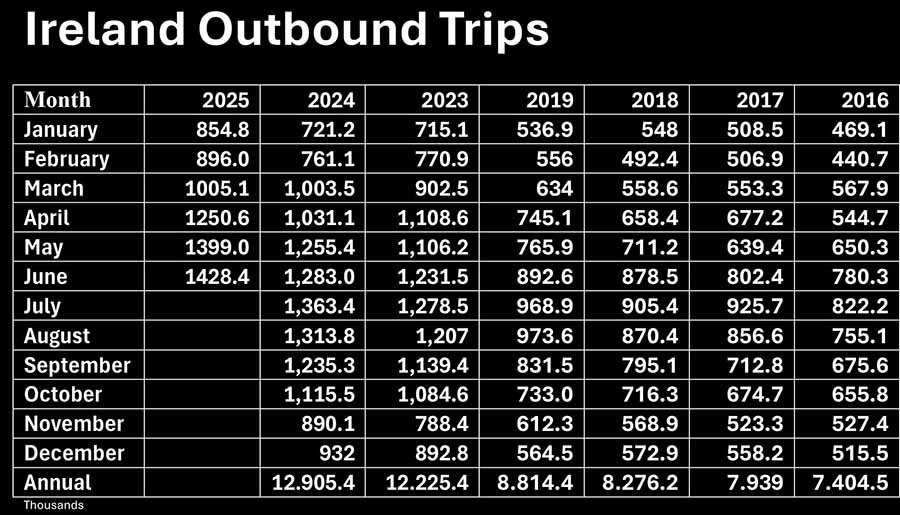

Ireland resident outbound trips were up 11.3pc on 2024 and up 60pc on pre-pandemic, although the figures form 2029 have been calle din to question for designating to low a proportion to outbound visitors. This compares with increase of 18.5pc in January, 17.7pc in February, 0.2pc in March (compared with March 2024 which included Easter), 21.3pc in April (affected by Easter), and 11.4pc in May.

The Irish Tourism Industry Confederation have pointed out that figures from other sources are closer to CSO findings than previous monthly reports. There is no change in hotel occupancy levels and other accommodations are down 1pc. Dublin airport passenger numbers (inbound and outbound) are up 5.8pc, Cork up 15pc and Shannon up 10.4pc in June. According to US immigration US citizens returning from Ireland are up 3.1pc.

Statistian Gregg Patrick shared: “The results show that 654,500 foreign visitors departed Ireland on overseas routes in June 2025, down 2pc compared with June 2024 and up by 6pc compared with June 2023. The number of nights spent by foreign visitors in June was almost 5.2m nights, an increase of 6pc compared with June 2024 and up 14pc compared with 2023. In June 2025, the greatest number of visitors came from Great Britain (34pc), followed by Continental Europe (31pc), North America (30pc) and the Rest of the World (5pc). The visitors’ expenditure in Ireland (excluding fares) was €647m in June 2025. The most frequent reason for the visitors’ trips was for holiday or leisure (47pc).”

Eoghan O’Mara Walsh, CEO of ITIC, shared “Irish tourism and hospitality businesses continue to have a mixed season. June numbers represent the beginning of the summer period and although North American business is performing well, other markets are soft. Cost of business pressures and capacity constraints continue to hamper the industry and we hope that these are addressed on Budget Day. With unprecedented macroeconomic and geopolitical uncertainty now is the time to support a key home-grown indigenous industry such as tourism”.

Paul Gallagher Chief Executive of the Irish Hotels Federation shared: “While our own industry data indicates that occupancy rates for hotels are on a par with last year, we are seeing a softening in revenue and room prices. This appears to be part of a wider decline in tourism spend so far this year as indicated by recent CSO figures.”

“If this weakness continues throughout the summer, it would pose a very significant challenge for tourism businesses nationwide that are already struggling under unsustainable increases in operating costs. This is at a time when we are experiencing difficult headwinds on a number of other fronts, including economic challenges across our key source markets, increased political uncertainty internationally and the fallout from EU/US tariffs – all of which threaten Irish tourism.”