It is a move that underscores the enduring global dominance of Ireland’s aircraft leasing sector. Air Lease Corporation (ALC), the renowned Los Angeles-based aviation giant, has entered into a definitive agreement to be acquired by a newly formed holding company headquartered in Dublin.

The transaction values ALC at approximately €6.8bn in equity, or €24.8bn when including debt obligations to be assumed or refinanced net of cash, marking a pivotal consolidation in an industry long shaped by visionary entrepreneurs like ALC’s founder, Steven Udvar-Házy, and Tipperary born Tony Ryan.

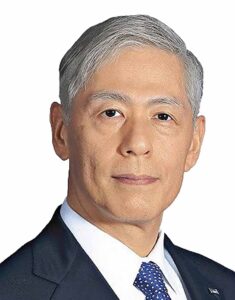

Peter Barrett of SMBC shared that Air Lease’s portfolio, focused on liquid, in-demand, new tech aircraft, made it an attractive opportunity for co-investors. The ALC portfolio consists of Airbus A320neo family, A350, Boeing 737 MAX, 787, and 777 aircraft. Clients include American Airlines, Delta Air Lines, British Airways, Emirates, and Ethiopian Airlines.

If the deal proceeds as planned, the combined group will overtake Avolon as the world’s second largest lessor, behind AerCap.

The deal

The acquiring entity, named Sumisho Air Lease Corporation, will be owned by a powerhouse consortium comprising Japan’s Sumitomo Corporation, Ireland’s SMBC Aviation Capital Limited, and investment vehicles linked to global heavyweights Apollo Global Management and Brookfield Asset Management.

Under the deal’s terms, ALC shareholders stand to receive €57.20 in cash per share of Class A common stock upon closing, a figure that translates to a 7pc premium over the company’s all-time high closing price on 28 August 2025, a 14pc premium to the 30-day volume-weighted average share price ending 29 August 2025, and a substantial 31pc premium to the 12-month average through the same date.

This cash payout, equivalent to roughly €6.8bn in total, has already propelled ALC’s shares upward in pre-market trading, reflecting investor enthusiasm for the premium and the strategic synergies ahead.

Air Lease will be renamed Sumisho Air Lease Corporation (“Sumisho Air Lease”) and its order book will be transferred to SMBC Aviation Capital.

Steve Hazy departs

Steven Udvar-Házy, the Hungarian-American billionaire often hailed as one of the godfathers of modern aircraft leasing alongside Tony Ryan, founded Air Lease Corporation in 2010 after a storied career that began in the early 1970s.

He retired from his role as Executive Chairman on 2 May 2025 – just months before this announcement – Udvar-Házy transitioned to non-executive Chairman of the board until ALC’s 2026 annual meeting. His departure caps a 60-year odyssey in aviation that saw him co-found International Lease Finance Corporation (ILFC) in 1973, revolutionising the sector by commercialising operating leases and enabling airlines worldwide to access modern fleets without prohibitive upfront costs.

ILFC, which grew to lease hundreds of aircraft to carriers across the globe, was sold to AIG for €1.14bn in 1990, cementing Udvar-Házy’s status as a trailblazer. Under his stewardship at ALC, the company amassed a portfolio of nearly 500 aircraft valued at over €28bn, with an additional €15bn in committed orders, leasing to more than 100 airlines in 60 countries and returning over €660m in capital to shareholders since its 2011 public listing.

Aer Lingus veteran Antóin Daltún shared: “Steve Hazy has had a long relationship with Aer Lingus, particularly in assembling a deal which introduced the A330 and disposed of two Aer Lingus B747s. This deal also found a first ETOPS operator for the type, allowed Air Inter to escape the type which no longer fitted domestic routes in France, and was good for ILFC which was his platform at the time.”

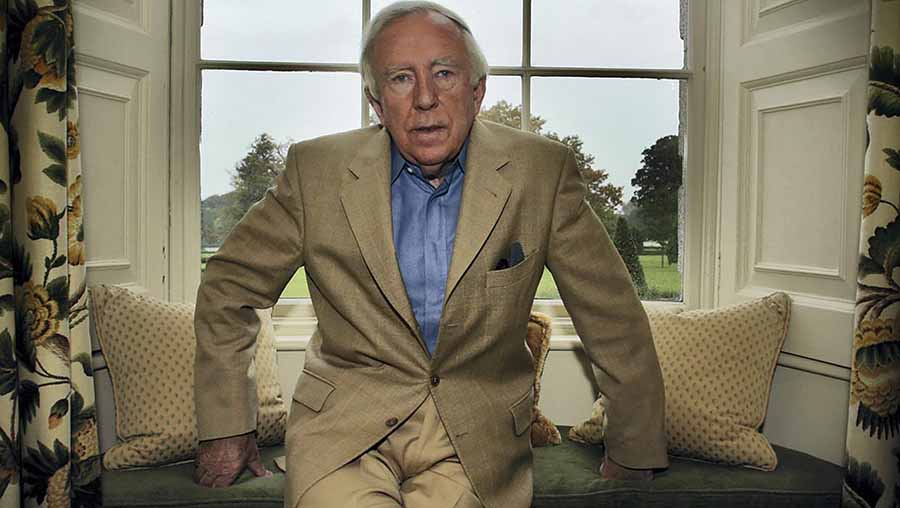

Ghost of Tony Ryan

This acquisition arrives at a poignant moment, evoking the parallel pioneering spirit of Tony Ryan, the late Irish entrepreneur whose innovations helped establish Ireland as the epicentre of global aircraft leasing.

Born in 1936 in County Tipperary, Ryan joined Aer Lingus in 1955 and rose through the ranks before spotting an opportunity in the 1970s to repurpose surplus aircraft during economic downturns. In 1975, with backing from Aer Lingus and the Guinness Peat Group, he founded Guinness Peat Aviation (GPA) in Shannon, investing just €4,400 of his own savings for a 10pc stake.

GPA exploded into the world’s largest aircraft lessor by the late 1980s, managing a fleet of 400 planes worth €3.5bn at its peak and leasing to airlines in over 40 countries.

It then imploded just as spectacularly. Though a ill-timed 1992 initial public offering amid the Gulf War recession led to GPA’s dramatic collapse – forcing a restructuring that split the company into entities later acquired by GE Capital Aviation Services (GECAS) and others – Ryan’s vision endures. His model not only birthed an industry employing thousands in Ireland but also laid the groundwork for the Ireland’s current €236bn aviation asset base, representing over 60pc of the world’s leased commercial aircraft managed from Dublin and Shannon.

Ryan, who passed away in 2007, also co-founded Ryanair in 1984, transforming European air travel with low-cost fares and leaving a family fortune estimated at €1.3bn. Today, as ALC integrates into a Dublin-based structure, it honours this transatlantic synergy, with SMBC Aviation Capital – itself a Shannon-rooted powerhouse – set to service the combined portfolio and absorb ALC’s order book.

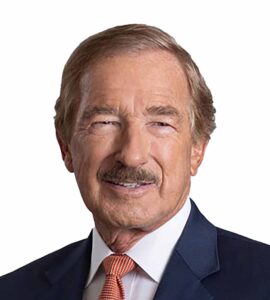

Plueger ponders

John L. Plueger, ALC’s Chief Executive Officer and President, who has partnered with Udvar-Házy for nearly four decades, hailed the deal as a fitting culmination. “Since founding Air Lease in 2010, we have been unwavering in our mission to shape the future of the aviation industry and provide airlines around the world with access to the most modern, fuel-efficient aircraft,” Plueger stated in the announcement.

He emphasised the transaction’s appeal amid surging demand for sustainable fleets, with ALC’s recent second-quarter 2025 results showing a 9.7pc year-on-year revenue increase to €640m, bolstered by a €300m insurance recovery and robust leasing activity. The merger, Plueger noted, will create one of the world’s largest lessors, with over 1,000 aircraft under management, enhancing scale in a market projected to require 20,000 new planes by 2045 to meet passenger growth and fleet renewals.

‘A masterstroke’

The Air Lease board has unanimously approved the agreement, with directors and key executives committing to vote in favour. No financing contingencies apply, but the deal remains subject to customary conditions, including shareholder approval and regulatory clearances from bodies like the US Federal Trade Commission and Ireland’s Competition and Consumer Protection Commission.

Closure is anticipated in the first half of 2026, after which ALC will delist from the New York Stock Exchange and operate under the Sumisho Air Lease banner, leveraging Dublin’s tax-efficient environment, extensive double-taxation treaty network, and skilled workforce – hallmarks of the sector Ryan helped pioneer.

The acquisition is a masterstroke in an era of industry consolidation, driven by post-pandemic recovery and the push for net-zero emissions by 2050.

With Ireland’s leasing hub generating €1.8bn in profits and €300m in corporation tax annually as of 2024, the transaction reinforces the nation’s role as a global aviation powerhouse, where assets under management have surged 52pc since 2014 to €268bn.

As the aviation world reflects on Udvar-Házy’s retirement and Ryan’s indelible mark, this Dublin-centric merger signals a new chapter of innovation and growth, ensuring the founders’ spirits continue to soar across the skies.

Peter Barrett shared, “There has always been consolidation in the aircraft leasing sector, particularly as the industry matures. I expect this to continue. This transaction is transformational for our business and the leasing landscape. Investing in Sumisho Air Lease, purchasing their orderbook and becoming servicer to the substantial majority of Sumisho Air Lease’s portfolio will enable us to deploy our financial scale and strength to meet the evolving needs of our customers and take a strategic lead in reshaping our sector.”

Joe O’Mara, head of aviation finance at KPMG Ireland shared “This deal not only reunites elements of the GPA legacy through SMBC but also positions the new entity to capitalise on €88bn in annual aircraft financing needs.